Manage all your customer loans and repayments in one place. Engage with customers with automated SMS and Email. Spend less time doing admin work and more time growing your business.

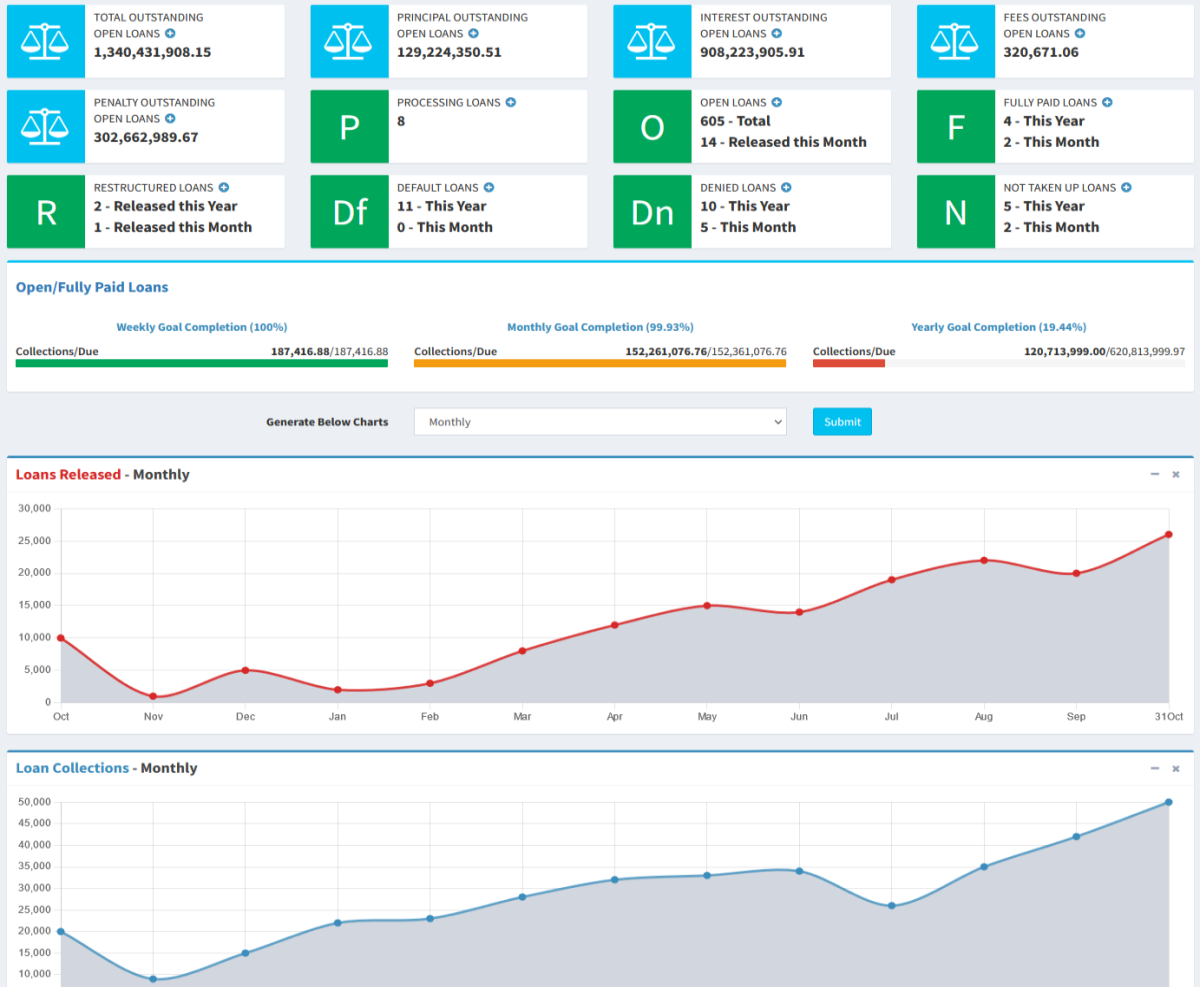

View detailed charts and see how your loan released and collections are changing month to month. You can also view cash flow reports and profit/loss statements. This will allow you to instantly see your business performance through graphic charts and take informed decisions.

Charts and Reports

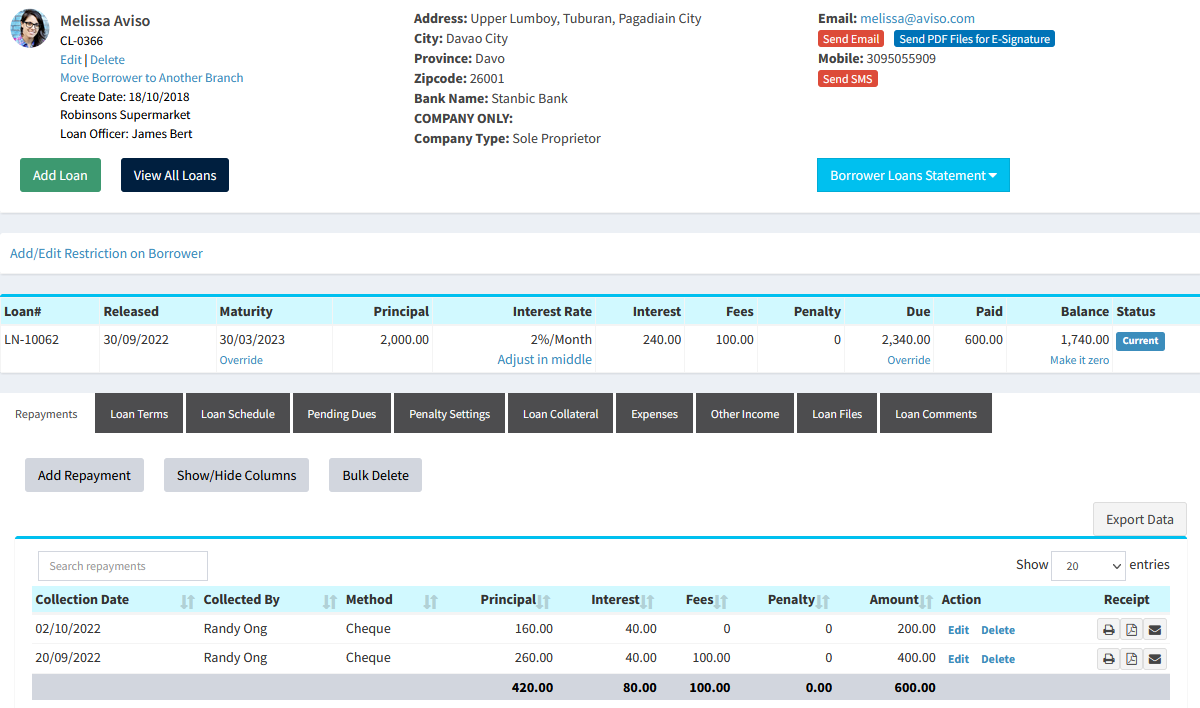

Loan Management

View loan details including repayments, loan terms, loan schedule, collateral, files, and comments. You can also print loan statements and schedule for your borrowers. Set loan fees, and penalties.

See a snapshop of the loan on one page. You can even send SMS and email to the borrower.

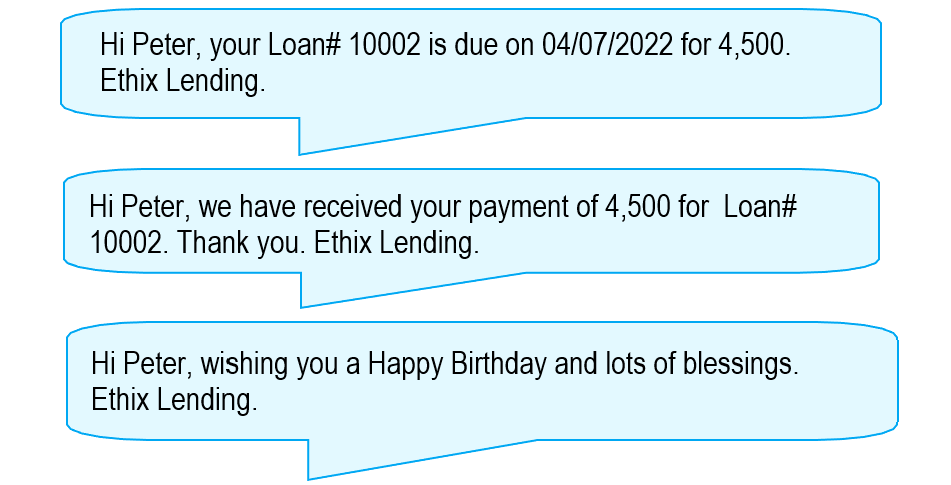

Automated SMS and Email

Send SMS and email to your borrowers for reminders before due dates, arrears, payment confirmation, successful loan application, or even birthdays. Set your own custom messages with placeholders so each borrower receives a personalized reponse from you.

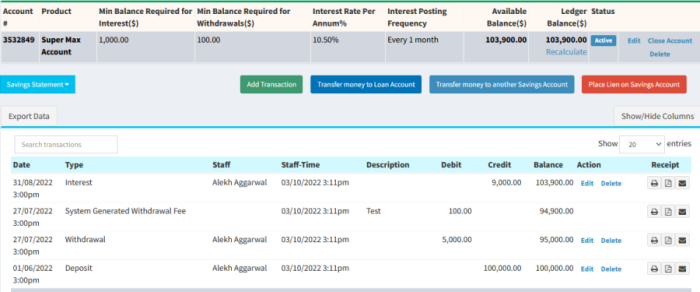

Savings Accounts and Investor Accounts

Create savings account for your borrowers and investor accounts for your investors. Add transactions such as deposits and withdrawals. You can also download and print statements. The system will automatically add interest to the account depending on your product settings.

Staff Management

Now you can manage your staff like a bank! You can assign branches to your staff and give them roles such as Cashier, Teller, Operations Manager, Collector, and Branch Manager. You can set permissions for each staff role and control what pages they can see and the branches they can operate in the admin area.

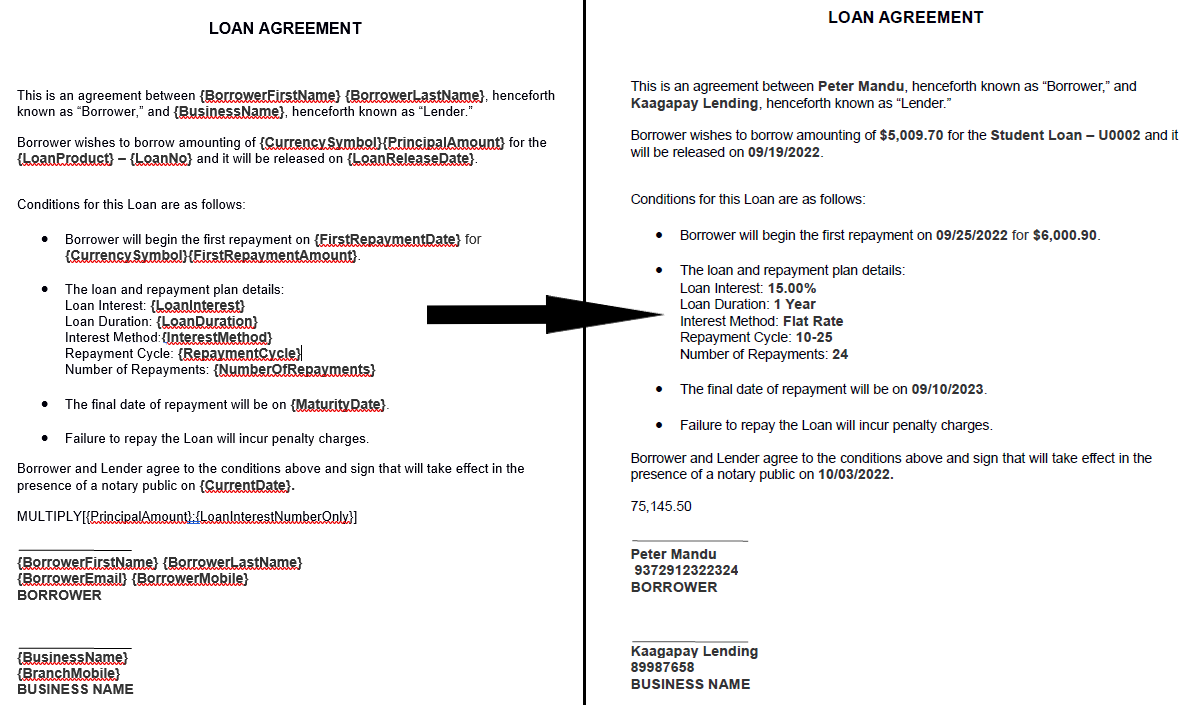

Auto-fill Loan Application and Agreements

Create your own custom application and agreements in DOCX file with placeholders . The system will then replace those placeholders with data from the loan. You can download the filled agreement in DOCX and PDF or send it via email or for E-Signature to the borrower.

Features

Borrowers

- Only First Name and Last Name and/or Business Name required to create borrower

- Add other optional details such as DOB, Email, Mobile, Gender, Description, Title, and Address

- Add your own Custom Fields

- Send SMS and Email to borrowers

- Upload files

- Upload photo of borrower

- Set your custom Borrower Unique Number format and the system will automatically generate it for each borrower

- Add Loans and Savings Accounts

- Invite Borrowers to Loandisk so they can see their loans, repayments, and savings account in the Borrower Control Panel

- Whitelabel solution for borrowers so they can login into your domain but access data from Loandisk

- Apply for loans in the Borrower Control Panel

- Assign Loan Officers to Borrowers so you can download collection sheets of loan officers

- Unlimited Borrowers can be added

- Bulk upload Borrowers via CSV

- Place restrictions on Borrowers

- Move Borrower to Another Branch

- Search borrowers via fields like name, borrower unique number, mobile, email, address, loan officers, and custom fields

- Filter borrowers based on last loan status for example you can search for all borrowers will fully paid loans

- Export Borrowers to Excel/CSV

Loans

- Add Loan Products

- Set your custom Loan Unique Number format and the system will automatically generate it for each loan

- Choose from Flat Interest, Reducing Balance - Equal Installments, Reducing Balance - Equal Principal, Interest-Only loans, or Compound Interest

- Released Date, Amount, Interest %, Duration, and Repayment Cycle

- Add your own Repayment Cycle or choose from default ones

- Set Penalties for late repayment and after maturity date and allow for grace period

- Set a different Interest Start Date

- First Repayment Date and First Repayment Amount can be manually set in Add Loan

- Add Loan Fees

- Select how loan was Disbursed

- Add Guarantors

- Set borrower or manually added guarantor for a loan

- Add Loan Agreement files

- Loan Calculator

- Add Custom Fields

- Set Loan Status to Processing, Open, Default, Not Taken Up, and Denied

- Approve Loans through different stages

- Set Loan Reminders

- Add Unlimited Loans

- View and print Loan Statement and Collection Schedule

- Add Repayment

- Add Bulk Repayments

- View Loan Terms

- Upload Files

- Add Comments

- Edit Collection Sheet

- Restructure Loan

- Override Loan Due Amount

- Early Settlement

- Add Collateral

- Reprice Loan

- Send bulk SMS to borrowers on the Daily Collection Sheet or the Overdue Loans Sheets.

- View Pending Due Loans

- View Missed Repayment Loans where no payment has been made for last installment

- View Arrears Loans where part payment has been made for last installment

- View Pending Due Loans

- View 1 Month Overdue Loans

- View 3 Months Overdue Loans

- Upload Loan Agreement Template

- Download Customized Loan Agreement for each loan

- Add Expense for a loan

- Add Other Income for a loan

- Extend Loan After Maturity until fully paid

- Bulk Upload loans via CSV

- Search loans via fields like name, loan number, loan products, loan officers, disbursed by, collateral status, release date, maturity date, and custom fields.

- Export loans to Excel/CSV

Repayments

- Add Repayment individually for each loan

- Add 30 Repayments at a time

- Add Bulk Repayments via CSV

- Set Collector

- Set Collection Method

- Add Custom Fields

- Recalculate loan on excess payment and give discounts on loan

- Manually allocate principal, interest, fees, and penalty of a payment or let the system calculate it

- Download Repayment Receipts

- Auto-fill amount and date based on payment due

- Approve Repayments

- Repayment Charts

- Search loans via fields like name, loan number, loan products, loan officers, repayment methods, amounts, collection dates, and custom fields.

- Export repayments to Excel/CSV

Collateral Register

- Add Collateral for Loan

- View Loan to Value (LTV) ratio

- Viwe and Manage all Collateral in a central branch Register

- Add Photo of Collateral

- Upload Files

- Search collateral via fields like status, types, borrower name, serial #, and custom fields.

Savings

- Add Savings Products

- Set Interest Rate

- Set Interest Posting Frequency

- Set Minimum Balance required

- Set Savings Fees such as monthly fee, once off fee, and withdrawal fee

- Add unlimited Savings Account

- Auto Generate Savings Account Number

- Add Custom Fields

- Add Transaction as Deposit, Withdrawal, Dividend, Transfer, Bank Fees, Commissions and Interest Amount

- Add Savings Transaction individually for each savings account

- Add 30 Transactions at a time

- Add bulk Transactions via CSV

- Approve Savings Transactions

- Add your own custom Transaction Types

- Print Savings Account Statement

- Savings Transaction Receipt

- Email Savings Account Statement

- System will automatically add interest to the savings account depending on the savings product

- Transfer money from Savings to Loan Account

- Transfer money from Savings to another Savings Account

- Place Lien on Savings Account

- Close Savings Account

- Savings Charts

- Savings Reports

- Savings Fee Report

- Send SMS and Email

- System will automatically assign status to Savings Account such as Active, and Overdrawn depending on balance.

- Search Savings Accounts via fields like name, savings account number, savings products, status, and custom fields.

- Search Savings Transactions via fields like name, savings account number, savings products, status, types, date, staff, loan officers, and custom fields.

- Export Savings Accounts to Excel/CSV

- Export Savings Transactions to Excel/CSV

Investors

- Add Investor Products

- Set Interest Rate

- Set Interest Posting Frequency

- Set Minimum Balance required

- Setup Fees such as monthly fee, and once off fee

- Add unlimited Investor Account

- Add Custom Fields

- Auto Generate Investor Account Number

- Add Transaction as Deposit, Withdrawal, Dividend, Transfer, Bank Fees, Commissions and Interest Amount

- Add your own custom Transaction Types

- Print Investor Account Statement

- Investor Transaction Receipt

- Email Investor Account Statement

- System will automatically add interest to the investor account depending on the investor product

- Add Loan Investment and directly invest in a specific loan

- Apply for Investments on Savings Account

- Invite Investors to Loandisk so they can see their investor account in the Investor Control Panel

- Whitelabel solution for investors so they can login into your domain but access data from Loandisk

- Apply for investments in the Investor Control Panel

- Close Investor Account

- Send SMS and Email

- System will automatically assign status to Investor Account such as Active, and Overdrawn depending on balance.

- Search Investor Accounts via fields like name, investor account number, investor products, status, and custom fields.

- Search Investor Transactions via fields like name, investor account number, investor products, status, types, date, staff, and custom fields.

- Export Investor Accounts to Excel/CSV

- Export Investor Transactions to Excel/CSV

Expenses

- Add Expense

- Set Expense Type

- Link Expense to a loan

- Add your own Custom Expense Types

- Upload Files such as Invoices and Receipts

- Set Recurring Expenses

- Add Custom Fields

- View and filter Expenses based on Expense Type

- Search Expenses via fields like type, date, and custom fields.

- Bulk Upload Expenses from CSV

- Export Expenses to Excel/CSV

Account Settings

- Set your local Currency

- Set your local Date Format

- Set your Number Format

- Upload Logo to show in statements and receipts

- Set your Company Name

- Set your Timezone

Branches

- Add Unlimited Branches

- Set Minimum and Minimum Loan Amounts

- Set Minimum and Minimum Loan Interest Rates

- Set Branch Holidays so the loan schedule skps those days

- Add Branch Capital

- Add Custom Fields

- Switch between branches

- Give staff access to specific branches

- Override Account Settings and set your own Branch Currency, Country, and Date Format

Staff, Roles and Permissions

- Add Staff

- Upload Photo of Staff

- Add other detail such as name, email, and address

- Assign Staff to Branch so they can't access other branches

- Set Login Restrictions on work days, work timings, IP Address, and Country

- Restrict Backdating or Postdating

- Restrict Add/Edit Repayments for Approval

- Restrict Add/Edit Savings Transactions for Approval

- Set Staff Roles for each staff such as Cashier, Teller, Admin, Collector, and Branch Manager

- Add your own custom Staff Roles and set permissions

- Set permissions for each staff role and control what pages they can see

Auto SMS/Email

-

The system will automatically send SMS and/or email depending on the categories you activate below:

- Processing Loan Added In System

- Open Loan Added In System

- Loan Remind Payment Before Due Date

- Loan Missed Repayment or Arrears

- Loan Past Maturity

- Loan Before Maturity

- Loan Fully Paid Confirmation

- Default Loan Set In System

- Denied Loan Set In System

- Not Taken Up Loan Set In System

- Add Repayment Confirmation

- Add Savings Transaction Confirmation

- Borrower Birthdays

- Investor - Open Loan Investment Added

- Investor - Add Investor Account Transaction Confirmation

- Add Borrower Confirmation

- Send Monthly Individual Loan Statement

- Send Monthly Savings Balance

- Send Monthly Investor Account Balance

E-Signature

- Send agreements and documents for E-Signature

- Client will receive a link on email to sign document

- Set your own custom E-Signature message

- Client will not know it is from Loandisk

- Client can fill fields, sign, draw, and upload photo in document.

- Receive email confirmation once document is signed

- View All Signed Documents

- View IP Address, Browser information and Signed Data and Time of the Document

Other Income

- Add Other Income

- Set Other Income Type

- Link Other Income to a loan

- Add your own Custom Other Income Types

- Upload Files such as Invoices and Receipts

- Set Recurring Other Income

- Add Custom Fields

- Download Receipts

- View and filter Other Income based on Other Income Type

- Search Other Income via fields like type, date, and custom fields.

- Export Other Income to Excel/CSV

Asset Management

- Add Asset Management

- Set Asset Management Type

- Add your own Custom Asset Management Types

- Upload Files

- Add Depreciation Values

- Add Custom Fields

- Search Asset Management via fields like type, date, and custom fields.

- Export Asset Management to Excel/CSV

Payroll

- Add Payroll for your Staff

- Automatically Generate Payslips

- Choose Payroll Templates

- Edit Template Fields

- Set Recurring Payroll

- View and filter Payroll based on Staff name

- Payroll Report

Bulk Upload

- Upload Borrowers from CSV file

- Upload Loans from CSV file

- Upload Repayments from CSV file

- Upload Expenses from CSV file

- Upload Savings Accounts from CSV file

- Upload Savings Transactions from CSV file

- Upload Loan Schedule from CSV file

Web form builder

- You can use Web Forms Builder to create forms and then embed those forms into your website. When the user submits the form, the response will go to Loandisk. You can see the responses in the Submissions section.

- Add Custom Forms

- View Submissions

- Export Submissions to Add Borrower or Add Loan

- Create multiple categories and move submissions to different categories

- Receive Email Notification when submission is made

Some of our Clients

We have over 600 clients from a wide spectrum of the lending industry including Microfinance Institutions, Lending Companies, Cooperatives, Banking Institutions, Pension Funds, Savings and Credit Co-Operative Societies (SACCOs), Auto Loan Companies, Payroll Loan Companies, and Investment Firms.

Our clients are located in almost 40 countries worldwide. Some of them are listed below.